Insights

Want these insights and updates straight to your inbox? Subscribe to our monthly newsletter.

CHECK OUT OUR CLIMATE IMPACT REPORTS:

trillion with a “t”

We are climate tech venture capitalists—we invest where technology can transition the world’s resources from finite to infinite. We see opportunity in the decoupling of economic growth from environmental degradation. We believe in markets—in capitalism. So we have to question whether it is fundamentally non capitalistic to subsidize oil and gas to the tune of over one TRILLION USD during their most profitable year ever.

We are climate tech venture capitalists—we invest where technology can transition the world’s resources from finite to infinite. We see opportunity in the decoupling of economic growth from environmental degradation. We believe in markets—in capitalism. So we have to question whether it is fundamentally non capitalistic to subsidize oil and gas to the tune of over one TRILLION USD during their most profitable year ever.

We understand the merit of and celebrate industry profits. Prices went up during a time of lessened global supply and demand remained high. Take climate change out of the equation and it makes perfect economic sense. Last year the largest oil and gas companies made $219B in profit and paid out $110B in dividends and share buybacks. So why is it that during 2022’s record-breaking profits did subsidies (including tax breaks) double … and increase 5X from 2020?

At the same time, many of the largest oil companies reversed their pledges to cut production, transition to renewables and decarbonize. The surge in profits has removed the incentives for the industry to make a clean energy transition. Government subsidies are supposed to be the lever that creates incentives aligned with the public good—not inflating the profits of an entrenched industry whose interests are in conflict with a habitable planet.

What could be further from free market capitalism AND contrary to social/environmental welfare than subsidizing fossil fuel companies during their most profitable period … while at the same time incentivizing those companies to reduce their role in the clean energy transition? Did all that make your brain spin? Us too, because it’s nuts.

The world’s cash has a carbon problem

When we think about corporate carbon emissions, we probably envision a factory, a polluted river or maybe even waste in a landfill. So it may be a surprise to learn that the world’s largest company’s cash and investments generate significantly more emissions than their operations and supply chains combined.

When we think about corporate carbon emissions, we probably envision a factory, a polluted river or maybe even waste in a landfill. So it may be a surprise to learn that the world’s largest companies cash and investments generate significantly more emissions than their operations and supply chains combined. When a company holds cash (A LOT of cash in the case of the world’s largest companies) banks invest that money in energy development, construction projects, loans to other businesses and a multitude of other activities that all generate emissions. These scope 3 emissions have a BIG impact. The Carbon Bankroll Report notes that Apple’s $191M in cash and investments in 2021 generated 14.9M tonnes of emissions — nearly three times larger than the total emissions generated by the use of every Apple product in the world in the same year!

And, it’s not just confined to the cash and investments of large corporations. Pension funds represent ~$47T in capital, of which only 15% have a policy to exclude fossil fuels in some way and 65% have no climate policy of any kind (according to the BBC).

The good(ish) news is that the corporate sustainability movement is gaining momentum. All the companies listed above have made commitments to both net-zero and pathways to 1.5 degrees. Many have also created investment arms focused on climate solutions, like Microsoft’s $1B Climate Innovation Fund for carbon reduction and removal technologies.

Yet, the financial supply chain — despite even the most ambitious climate commitments — is funnelling billions to the industries driving the climate emergency. Since the 2015 Paris Agreement, the world’s 60 largest commercial and investment banks have invested $4.6T in the fossil fuel industry. Companies of all sizes, pension funds and their collective shareholders have a powerful role to play in pushing the financial sector to rapidly decarbonize. The universal language of cash, even passive cash reserves, may be one of the most important ways to mitigate climate disaster.

New Years Resolution: Drop 1M Tonnes

Happy new year! We always enjoy the experience of taking time to look back at what happened last year — it's amazing what you can pack into just 12 months. Following a year of building our team and growing our assets under management by 7X, in 2022 we hit the accelerator with nine new portfolio companies, nine follow-on investments, exit number two, over 50 final pitches to our investment committee and hundreds of other companies evaluated. But the list of transactions only tells half the story.

Happy new year! We always enjoy the experience of taking time to look back at what happened last year — it's amazing what you can pack into just 12 months. Following a year of building our team and growing our assets under management by 7X, in 2022 we hit the accelerator with nine new portfolio companies, nine follow-on investments, exit number two, over 50 final pitches to our investment committee and hundreds of other companies evaluated. But the list of transactions only tells half the story.

We focus our post-investment support on the three areas where we see the greatest need: sales, talent and fundraising. Since our initial investment, our Fund I companies have grown their revenue an average of 9.8X and across both funds we’ve seen an average 20% quarter over quarter sales growth. In 2022, we helped our portfolio companies raise $126M in addition to our investment capital. We built out our recruiting and talent function and have now placed a total of 14 key hires across our portfolio companies, and are proud that 64% of those are female and 36% are sales leaders. We look for ways to put our founders first at every step from screening to support to exit, which is why we're proud that they gave us a 9.6 (out of 10) satisfaction score.

In 2022, global markets were humbling to put it lightly. Every quarter we present an update to our investors and each time we take a sober look at what’s going on at the macro level. This lead to an action plan to help prepare for an expected rough year so we were pleased that each quarter we had multiple up-rounds underway and every one of the 28 companies we’ve invested in is still operating. The positive outlook isn’t just due to us of course, or even the incredible founders that comprise our portfolio — it’s also largely because the world is finally waking up to both the crisis and opportunity posed by climate change. Climate tech has been one of, if not the most insulated sector in this recession with policy tailwinds like the USA's $374B Inflation Reduction Act and the EU’s Carbon Border Adjustment Mechanism. But the excitement of the opportunity is only outweighed by the seriousness of the crisis as shown by the extreme flooding in Pakistan and prolonged, extreme heat and drought in China. So, the accelerator stays pressed and our ambitions stay high — in 2023 our goal is for our portfolio companies to mitigate 1M tonnes of CO2 and equivalents.

Here’s our annual round up of major events:

January

Fund II invests in Tengiva

GoJava follow-on investment

Kelley joins as Operations Coordinator

February

Fund II invests in Optiwatt (lead)

Manifest Climate follow-on investment

Alana joins as Principal

March

Awarded Foresight Canada’s “Cleantech Innovation Funder of the Year”

Therma Bridge to Series A

Sametrica Bridge round

April

Named the “Public’s Favourite VC” on the global Climate50 list

Fund II invests in Sustain.Life

Fund II invests in Flair (lead)

SWTCH follow-on investment

Carbon America follow-on investment

May

Fund II invests in Future

June

Solstice follow-on investment

Aquacycl follow-on investment

July

B Corp recertification with top 10% overall global score

Fund II invests in Metafold (lead)

August

Audette follow-on investment

Keela Bridge round

Therma Series A

September

Fund II invests in King Energy

Sale of Solstice to MyPower Corp.

October

Awarded Canada Clean50 status

Fund II invests in Agrology (lead)

RailVision follow-on investment

November

Clean Crop follow-on investment

ChopValue Series A

December

Fund II makes investment #13 (lead, to be disclosed soon)

Aquacycl Series A

All we want for our sustainable future is…

This month marked the close of COP27 in Egypt, the 27th United Nations Climate Change Conference. The close of COP is always a bit of a high/low in the climate world — high because we have to be optimistic about the progress delivered by the global gatherings, low because there’s usually some counterbalancing force that pulls the progress back.

This month marked the close of COP27 in Egypt, the 27th United Nations Climate Change Conference. The close of COP is always a bit of a high/low in the climate world — high because we have to be optimistic about the progress delivered by the global gatherings, low because there’s usually some counterbalancing force that pulls the progress back. Some good news from this COP is that a final agreement was reached to develop a loss and damages fund whereby the richest countries would compensate developing countries to ease the financial burden of being the most acutely affected by climate disasters … though the most contentious components of the agreement won’t be ironed out until the next COP. It’s also worth noting that there was an explosion in the number of oil and gas lobbyists with 636 in attendance, “a rise of more than 25% from last year and outnumbering any one frontline community affected by the climate crisis,” according to the Guardian.

Al Gore opened the conference and surely many of you (like us) remember the moment you saw An Inconvenient Truth for the first time. Perhaps the film was an awakening for you like it was for many on our team. Just as he did in the 2006 documentary, Gore delivered sobering truth bombs at the conference — including highlighting the 600K Hiroshima bombs’ equivalent of heat that humanity emits PER DAY, backing his claim that we "treat our atmosphere like an open sewer”.

But Al Gore also listed some incredible progress that should be celebrated: 90% of all new energy installed last year was renewable, solar is now the cheapest power in history and renewable energy nets 3X more jobs than oil and gas. The environmental transition underway holds the biggest opportunity ever. The narrative of mitigating and adapting to climate change needs to be about all the benefits — all the cool, star trek-esque progress that will come along with our sustainable future. Our team is especially lucky in that we get to see innovation as part of our everyday business, so we want to share a couple highlights that are especially cool … like a wish list for the net-zero reality that is within reach:

Seaweed supplements that reduce cattle methane emissions

Net-negative concrete made with algae that sucks carbon out of the air

Affordable family cars that have a solar panel shell to self-charge in the sun

Coding seed DNA with sensors so plants can communicate their nutrient needs

3D printing any inventoried part locally and automatically with zero waste

Lab cultivated fungi to break down waste

Symbiotic fungi in tree root systems to increase growth rates

Using microbubbles in farm irrigation systems to more efficiently deliver nutrients

Our first SOCAP in three years

Tom and Mike just got back from the annual SOCAP conference in San Francisco after a three year COVID hiatus. SOCAP is one of the largest conferences in the impact investing/"social capital" world, with over 2000 attending in person and another 2000-ish online. A couple key takeaways from their experience…

Tom and Mike just got back from the annual SOCAP conference in San Francisco after a three year COVID hiatus. SOCAP is one of the largest conferences in the impact investing/"social capital" world, with over 2000 attending in person and another 2000-ish online. A couple key takeaways from their experience:

Impact is (finally) mainstream. There has been huge progress in the impact investment world in the past three years. People no longer need to be convinced that above market returns are possible. People have stopped complaining about a lack of products available in the market. There is general consensus on the role of ESG (defence) vs impact (offence). The money and top talent has flooded in.

Specialization is key. Just like Active Impact Investments made the decision to specialize exclusively in climate tech, most other funds have moved to a singular impact focus. This has caused a healthy splintering away from generalist events to a whole new host of events with deep domain expertise attracting real solutions and those that want to finance them.

GV and SOSV are awesome. In fact, for us they were the best two events. We hosted a small private dinner with Andy Wheeler from GV (formerly Google Ventures) who spoke about his experience in climate related investments and what excites him about the future. I think all the attendees got a lot out of his talk and Q&A because we certainly did. We also attended the SOSV breakfast event where we were inspired by their global approach to solving deep tech climate problems and how they have scaled.

Nothing beats in person. In addition to making new connections, we got to see Orianna pitch our portfolio company Aquacycl on the mainstage and hang out with our Canadian ecosystem friends like InBC, McConnell Foundation, Genus Capital Management, Rally Assets, Good & Well, Raven Indigenous Capital Partners, Renewal Funds, Amplify Capital, Spring Activator, SVX and more.

The best stories are never reported. You will have to call and ask if you want to know about our buffet lunch strategy, the dumpling war, middle aged men sharing a hotel room, where to buy cheap sunglasses and how drinking alcohol can lead to food waste at late night events.

What do EV batteries have to do with Truth and Reconciliation?

From electric cars (EVs) to solar panels — there is a particular cocktail of minerals required by the clean energy economy of the future. The transition is necessary, therefore the resource components are necessary — but where those minerals come from, how they are extracted and who benefits from their extraction really matters.

From electric cars (EVs) to solar panels — there is a particular cocktail of minerals required by the clean energy economy of the future. Production of lithium, nickel, copper, cobalt, and other key minerals will have to quadruple over the next two decades to meet the Paris target of 2°C warming. The transition is necessary, therefore the resource components are necessary — but where those minerals come from, how they are extracted and who benefits from their extraction really matters. This month we’re reflecting on how mineral extraction intersects with Indigenous Rights, Truth and Reconciliation.

See here how EVs and clean power generation compare to their fossil fuel counterparts in terms of mineral requirement. An offshore wind plant today requires 12X more mineral resources than an equivalent gas plant. Source: The Carbon Brief

What’s problematic is that the largest deposits of the most crucial minerals are within Indigenous lands … but more often than not the extraction rights are owned by someone altogether different. Cobalt gets a lot of attention because 70% of the world's supply is in the Democratic Republic of Congo, but 80% of the industrial mines are owned by Chinese companies. A giant storehouse of these minerals lies at the bottom of the Pacific Ocean, but their extraction has unknown, potentially very large environmental consequences. The mining rights on the seafloor deposits have been largely allocated to small island nations who will bear the harshest negative climate impacts — but those rights are being acquired for a fraction of their lifetime value by foreign companies. And here in Canada, a huge, remote area in northwestern Ontario known as the Ring of Fire holds massive deposits of nickel, copper, platinum and palladium underneath an expanse of undisturbed peatland that is storing as much or more carbon than would be mitigated by the EV production the minerals could facilitate. The interests of mining companies and the Ontario government are in legal combat over the Indigenous rights that control the area.

They say history doesn’t repeat but it rhymes. The world is at the precipice of repeating the same colonial, extractive paradigm that defined the fossil fuel age. To facilitate a just and equitable transition to a clean economy, we have to change our thinking about how we consume resources.

The good news is that there are a number of innovators and start-ups deploying solutions that make the use of resources more efficient or completely change the composition of what’s needed EV/battery related issues can be addressed by innovating the battery supply chain:

Redesign without the need for precious metals, like batteries made with seawater or thermal batteries,

Reduce the battery capacity needed like battery swapping or integrating novel solar panels into the design of EVs to charge while driving,

Redeploy used EV batteries for energy storage broadly, and

Recycle materials and responsibly manage batteries at the end of life.

Innovations alone won’t ensure that the value created from mineral extraction is shared equitably, but as impact investors we think deeply about how the companies and industries we invest in can create systemic positive change — for the climate and society. The clean transition is an exceptionally rare opportunity to recalibrate all industries, beyond just climate tech, to make sure we utilize the resources we have in the best way possible and to integrate the values of justice, equity and reconciliation.

What’s a meat lover to do?

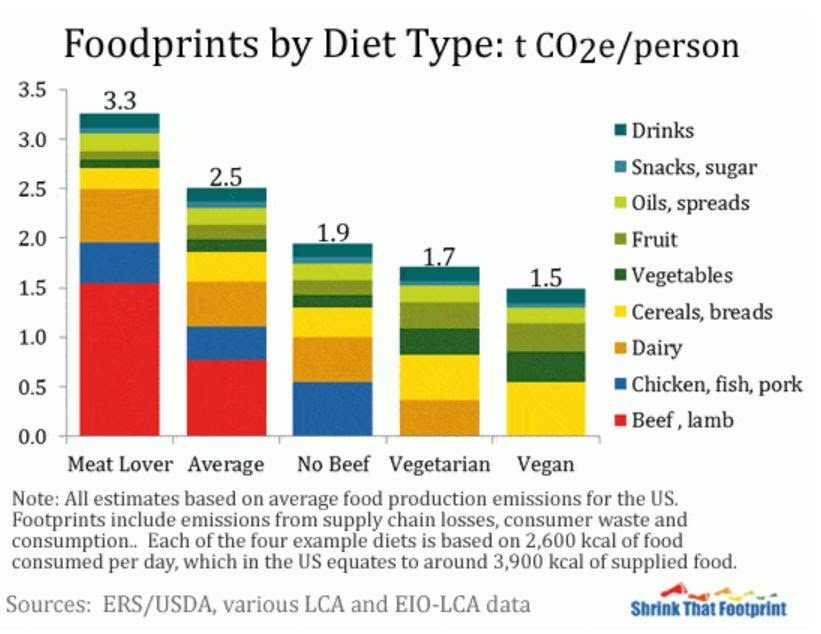

Buckle up because we’re about to ruminate on a pretty contentious topic: meat and climate change. The impact of eating meat as it pertains to climate is clear: there are more greenhouse gas emissions associated with meat calories than plant calories. It’s a huge source of optimism to see the rapid adoption of plant-based diets, and the quality and availability of new alternative product options. But we also recognize that it’s unrealistic to expect the whole world to stop eating meat any time soon.

Buckle up because we’re about to ruminate on a pretty contentious topic: meat and climate change. The impact of eating meat as it pertains to climate is clear: there are more greenhouse gas emissions associated with meat calories than plant calories. It’s a huge source of optimism to see the rapid adoption of plant-based diets, and the quality and availability of new alternative product options. But we also recognize that it’s unrealistic to expect the whole world to stop eating meat any time soon. There are plenty of people, many of our team included, who face the ever-nagging internal conflict of genuinely enjoying meat while still wanting to make environmentally positive choices.

It can be debilitating to consider the climate in every consumer choice we make — especially one as important and pervasive as diet. The food system accounts for about 25% of all global emissions, 14-15% is from agriculture and half of that is directly from livestock … and 75% of all livestock emissions are from cattle. Cattle need 28X more land, 11X more water than pork or chicken and are the single largest source of methane, which is 80X more warming than CO2. Not to mention the tangential effects of deforestation, water table contamination, antibiotic resistance, pesticides and soil erosion. Yikes, that's a high price to satisfy that Big Mac craving.

There are nuances in land management and grazing cattle can (when done regeneratively) actually sequester carbon — but that is not what’s happening in your conventional grocery store or between fast food buns.

Another nuance worth mentioning is the $38B+ that the US government spends on subsidizing the meat and dairy industry each year. These subsidies help the meat industry stay profitable while continuing to incentivize meat consumption by keeping consumer prices low. The real, raw price of a pound of beef without these subsidies is estimated to be $30 – much steeper than a lot of us are willing to pay.

So what’s the easiest way to get 90% of the climate benefit with 10% of the sacrifice? When you do decide to eat meat, have a smaller portion size and ensure none on the table goes to waste. Don't eat meat with every meal so it becomes a treat/luxury and recognize that the climate cost of a ‘meat treat’ isn’t flat, as not all meat is created equal — cow products (that’s you too, dairy) are by far the worst climate offender. Eating more plants is a hugely positive choice, but strictly limiting beef and dairy in favour of other meats is as well. The privilege of having so many options in our grocery stores comes with the responsibility of making informed decisions – and luckily, lab grown meat and alternative meat and dairy products are becoming more available, more delicious and cheaper! We believe that in the near future eating less meat and choosing alternative proteins won’t be a sacrifice … it will be a staple and meat will be seen as the luxury it very much is.

Taking it on the (Man)chin

We were all set to lead this newsletter with a cranky roundup of the climate policy backtracking that happened in the US and Europe in July … but then the news got a lot rosier! Just when it looked like the coal-industry funded senator from West Virginia was about to sewer any hopes for meaningful climate action, the surprisingly robust $370B USD Inflation Reduction Act was announced.

We were all set to lead this newsletter with a cranky roundup of the climate policy backtracking that happened in the US and Europe in July … but then the news got a lot rosier! Just when it looked like the coal-industry funded senator from West Virginia was about to sewer any hopes for meaningful climate action, the surprisingly robust $370B USD Inflation Reduction Act was announced. The bill takes aim at runaway inflation by making the biggest climate investment in US history. Finally! Some movement toward what the climate tech/impact investing crowds have been screaming — that investing in innovation that promotes climate sustainability and adaptation is a massive opportunity that will lead to economic growth. To be fair, the bill isn’t perfect and at a global scale there is PLENTY more work to do … but we’re all for celebrating wins as they come, and this is definitely in the “W” column.

Highlights:

Puts the US on track to reduce overall emissions to 40% below 2005 levels by 2030, which is near (but not all the way to) the Paris target.

Long term tax credits that incentivize new technologies to scale more quickly, including clean energy, clean hydrogen, and carbon capture, sequestration and storage.

Tax credits for manufacturing and supply chains, especially for domestic clean technologies.

Incentives to build renewable power generation facilities where coal plants and mines have closed.

And, by creating a minimum 15% tax on corporate profits, closing loopholes and funding tax enforcement, the total package reduces the overall deficit by $300B over a decade.

Our friends at Climate Tech VC have a more detailed summary here

Lowlights:

Requires the federal government to auction new lands and waters for fossil fuel development.

It hasn’t fully passed yet.

We’ve all had conversations with loved ones or strangers about climate change denialism, where it seems like reaching an agreement or changing someone's mind is impossible. Climate legislation in the US had us feeling similarly, but this historic package formed after so much contention (and barring any cataclysms in the ratification process) makes us hopeful that even the most disparate views can come together to make progress on this — the most important issue.

Fighting through a rip current

It’s immeasurably frustrating that the Supreme Court of the United States has ruled in three cases against the will of the vast majority of citizens, against progress and against reason. Women’s rights and bodily autonomy, and the ability to restrict guns have been under attack for years. We definitely have thoughts on both, but for the purposes of this newsletter we will focus on the big blow to the Environmental Protection Agency's power to regulate emissions delivered last week.

It’s immeasurably frustrating that the Supreme Court of the United States has ruled in three cases against the will of the vast majority of citizens, against progress and against reason. Women’s rights and bodily autonomy, and the ability to restrict guns have been under attack for years. We definitely have thoughts on both, but for the purposes of this newsletter we will focus on the big blow to the Environmental Protection Agency's power to regulate emissions delivered last week.

The issue before the court was how the EPA can regulate coal-fired power plants, which are the single largest source of emissions in the US. The opinion stated that under what the court has recently called the "major questions doctrine," neither the EPA nor any other agency may adopt rules that are "transformational" to the economy — unless Congress has specifically authorized such a transformative rule to address a specific problem, like climate change. This ruling will immediately limit environmental protection and is especially regressive given that there were 112 environmental protection rules that were rolled back during the Trump Administration that will likely be interpreted as transformational to the economy — meaning they are on the chopping block in their entirety.

But there’s an interesting dynamic presenting itself despite this ruling: the economic case for climate tech. In 2015 the Obama administration created state by state carbon limits meant to limit coal use that were blocked by the courts, but the coal reduction targets proposed were still met 11 years ahead of schedule simply because coal was no longer cost-competitive with cleaner options.

That’s why we exist. If we can continue to funnel resources to products and services that are better for the planet AND are more profitable, the guiding hand does the work.

We’d like to believe that every administration in every country in the world will support legislation that combats climate change and reduces emissions for the foreseeable future — but that’s sadly not the reality. What we’re working to shape is a world where decisions that are really good for the planet are the clear economic winners — like procuring wind and solar energy to lower bills or purchasing an EV fleet because the lifetime cost of maintenance is so much cheaper. Yes, regulation is still required to make the transition in time, but courts won’t stop the transition from happening as long as we build better stuff, and that’s what our dollars will continue to focus on doing.

My groceries are how much!?!

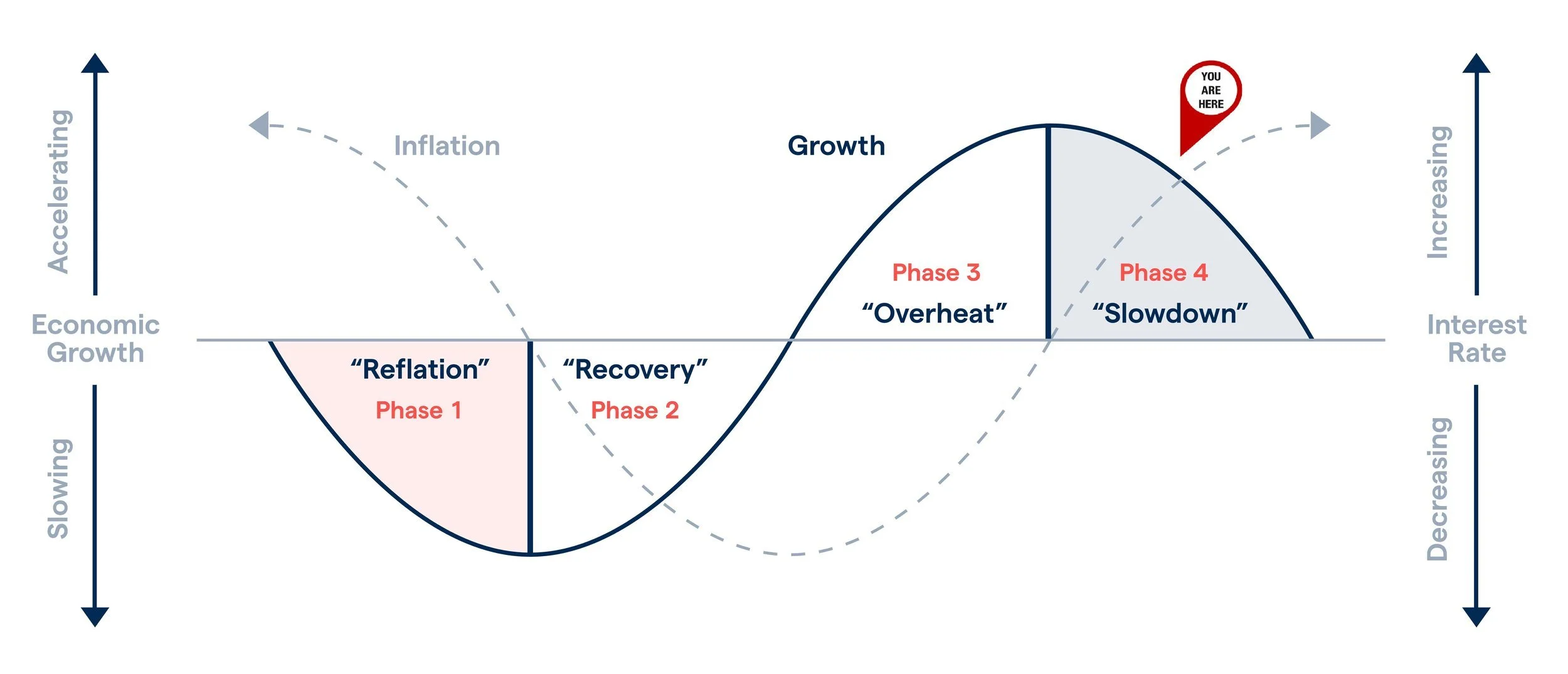

Like the rest of the world, exclusive of industry, the hot topic around here is inflation and market downturn. Canada's consumer price index rose 6.8% last month compared to 2021 and groceries jumped 9.7% — the largest increase since September 1981. Oh, and gas prices are up 36.3% year over year! And, just like every family, founders are feeling the crunch right now.

Like the rest of the world, exclusive of industry, the hot topic around here is inflation and market downturn. Canada's consumer price index rose 6.8% last month compared to 2021 and groceries jumped 9.7% — the largest increase since September 1981. Oh, and gas prices are up 36.3% year over year! And, just like every family, founders are feeling the crunch right now.

We’re in a near perfect economic storm for businesses. Input costs are up (it costs more to make what they make), interest rates are up (money costs more to borrow), and as governments begin to take action to slow inflation the markets have started to downturn, dampening demand for products and services (it’s getting harder to sell) and fundraising is becoming more difficult. But just like when a new Intergovernmental Panel on Climate Change (IPCC) report comes out, we need to act decisively and strategically … not panic.

As our founders, investors and regular readers of this newsletter know, we are very ‘active’ investors (pun always intended). This month our team gathered to triage the market’s impact on our portfolio companies and to tailor playbooks to support each. Writ large, we’re recommending ways each company can continue to grow, find capital efficiencies and to decrease risk where possible. More specifically (and we hope this is valuable to all reading this), top priorities for companies to focus on are:

Get visibility into your true financial picture

Be clear on strategic priorities

Cut and lock in costs where possible (and strategically)

Variable-ize your costs

Evaluate where prices may need to and/or can increase

Invest in automation with near-term payback, like financial systems

Plan ahead for future financing needs and adjust expectations

Importantly, we see companies that mitigate emissions and create environmental impact while delivering customer savings (aka the companies we invest in) as being insulated from many of the macro conditions. Attracting talent, obtaining non-dilutive financing, policy tailwinds and accessing capital all favour climate-saving companies in today’s competitive market. We’re not counting any proverbial chickens … but with support, prudence and unflinching commitment to positive impact we think there is still lots of room for climate positive companies to win.

The injustice of climate change

When people think of the "why" behind working to mitigate climate change, the livability of the planet for future generations is often front and centre. But this planet right now is inhabited by a single human species, members of which are affected by climate change in vastly different ways. This raises the important issue of climate justice.

When people think of the "why" behind working to mitigate climate change, the livability of the planet for future generations is often front and centre. But this planet right now is inhabited by a single human species, members of which are affected by climate change in vastly different ways. This raises the important issue of climate justice. The richest 1% of humanity have a footprint 30X larger than what’s compatible with 1.5°C of warming. Even the richest 10% globally (which includes almost every reader of this newsletter) has a footprint 9X the 1.5°C threshold and growing. By contrast, the poorest 50% of the global population emit far below the 1.5°C-aligned level. Furthermore, the contributors to climate change are financially equipped to avoid the worst effects — at least for now. Meanwhile, the news is replete with stories of the impoverished suffering from heat waves, lack of sufficient clean water and other climate related catastrophes causing death or extremely harsh living conditions where survival is a daily challenge.

There is a common misconception that the pollution of industrializing countries is the problem — it’s not. The most advanced societies are by far the biggest contributors to the crisis, yet the effects are born most acutely by the most vulnerable. By investing in solutions that decarbonize the planet, we can help avert some of the worst impacts of climate change and raise the standard of living for the less fortunate members of our human family. As we proclaimed when we were raising Fund II, this fight is about making the transition from finite to infinite resources.

Canada’s Emissions Reduction plan has a LOT to do with carbon capture

Last week the Canadian federal government released their 2030 Emissions Reduction Plan with Justin Trudeau making the announcement at the GLOBE conference here in Vancouver. The plan details a reduction in emissions across the whole economy by 40-45% below 2005 levels by 2030, and net zero by 2050.

Last week the Canadian federal government released their 2030 Emissions Reduction Plan with Justin Trudeau making the announcement at the GLOBE conference here in Vancouver. The plan details a reduction in emissions across the whole economy by 40-45% below 2005 levels by 2030, and net zero by 2050. As with any major climate policy, the initial reviews are mixed with environmental groups critical of the concessions to the oil and gas sector and major industries knocking the targets as unreasonable. This is of course an overly simplistic generalization … what is definitive is that the plan includes $9.1B in new investments, an escalating price on carbon and sector specific policy action for buildings, vehicles, agriculture and almost everything in between.

Source: IPCC, Global CCS Institute, Golman Sachs Global Investments Research 2020

The plan is highly reliant on engineered climate solutions, particularly carbon capture, utilization and sequestration (CCUS). CCUS is slated to cut ~13% of the oil and gas sector’s projected emissions. The plan details additional funding to enable the planned amount of carbon capture, up from the 0.05% that’s realistic today. Last week, we hosted an ‘Ask Me Anything’ with Stephanie Karris, a PhD in Chemical Engineering with a focus on carbon utilization who’s investing strictly in utilization and storage solutions. It was refreshing and fascinating to hear directly from a leading scientist and investor in the field just how advanced the technology is and that Canada’s target isn’t so far fetched. Point-source capture, where emissions are captured from heavy industrial processes before they are emitted into the atmosphere (which is what our portfolio company Carbon America specializes in) is the most feasible from a cost to potential scale perspective. The reality is that the technology exists, is viable, and with the appropriate investment has the potential to complement genuine emissions reductions — to both right our future course and correct the wrongs of the past.

Horrors in Ukraine highlight another reason to ditch fossil fuels

Our hearts are with all those affected by the invasion of Ukraine. Every week we close our team huddle with a “Why” leader and this week we focused on the devastating events in Europe. The human toll is top of mind for all of us but for the purpose of this newsletter we are going to stay in our lane and focus on how this conflict relates to climate and sustainability.

Our hearts are with all those affected by the invasion of Ukraine. Every week we close our team huddle with a “Why” leader and this week we focused on the devastating events in Europe. The human toll is top of mind for all of us but for the purpose of this newsletter we are going to stay in our lane and focus on how this conflict relates to climate and sustainability.

One of the key issues brought to bear is the heavy reliance on Russian oil and gas exports. While the world imposes some of the toughest-ever sanctions on Russia including exclusion from the SWIFT banking system, there is one key, ubiquitous exclusion — energy. The Russian invasion in Ukraine is in part funded by revenues realized from the Russian export of oil and gas to European nations. This highlights that transitioning to a decentralized, multi-source, renewable energy system is not only a matter of global sustainability but also geo-political stability. The faster the transition can occur, the sooner we can all benefit from those outcomes.

This graph illustrates the large scope of the dependency.

Superstar team vs. team of superstars

We believe the most important thing businesses can do to succeed is to create the right culture. And, it’s better to hire early in anticipation of future bottlenecks rather than reacting when the bottlenecks occur. This is the conundrum that has dominated our last nine months as we’ve doubled our team to ten people.

We believe the most important thing businesses can do to succeed is to create the right culture. And, it’s better to hire early in anticipation of future bottlenecks rather than reacting when the bottlenecks occur. This is the conundrum that has dominated our last nine months as we’ve doubled our team to ten people. Hiring people isn’t very hard, but hiring the perfect blend of the best people for your organization at any given moment while maintaining an exceptional culture is remarkably difficult. We screened over 400 quality candidates since the summer, increased our deployment pace, and strengthened our portfolio support function, all at the same time. There's no sugar coating it, some of those days and weeks were long, tiring and full of debates on the right path forward, but we always knew it would be worth the hard work in the end.

During this time, we’ve learned that our hiring process is unique and our culture is a real differentiator. Here’s a couple cultural practices we think create our superstar team:

Hire well: After initial interview questions, all final shortlisted candidates for any position always do a demo project. By evaluating a task we’re able to screen for certain behavioral attributes and emphasize talent over experience.

Shared mission: First thing every Monday we have a full team huddle that starts with shout-outs — popcorn style appreciation across the team. To close the huddle we have a rotating ‘Why Leader’ who speaks to why they would do this work even if they weren’t being paid. The ritual creates a culture of gratitude while also encouraging everyone to lead with their “why”.

Prioritize joy: We celebrate A LOT. Sure there’s birthdays … but also new homes, pets, babies and all the other important parts of someone's life beyond work. We also host monthly outdoor activities and try to involve extended families as much as possible. Making people feel good and encouraging laughter can’t be overemphasized!

Challenge the status quo: All team members are empowered to breathe life and our values into any mundane system or process that becomes standard. We value courageous candor.

Put more simply, a superstar team beats a team of superstars any day of the week. These core components of our culture have allowed us to attract the right talent from industry titans and competing organizations — people who are brilliant and selfless, accountable and hungry to keep learning. We’ll continue to prioritize culture, because we continue to see the dividends it can pay.

That was a BIG one!

2021 was the biggest year ever for this humble fund that started in the basement of the Winterfield house. It hardly seems real that in one year we doubled our team to nine people and upgraded our office, invested in eight new portfolio companies (which is five more than we made in 2020), had our first exit and distribution AND launched/closed Fund II surpassing our goal … all while Fund I achieved nearly 6X revenue growth.

2021 was the biggest year ever for this humble fund that started in the basement of the Winterfield house. It hardly seems real that in one year we doubled our team to nine people and upgraded our office, invested in eight new portfolio companies (which is five more than we made in 2020), had our first exit and distribution AND launched/closed Fund II surpassing our goal … all while Fund I achieved nearly 6X revenue growth.

It’s now reasonable to say that the sustainable transition is inevitable. Climate tech is the fastest growing vertical in venture capital with $0.14 of every venture dollar going to climate and over ~$100B in new climate dedicated funds raised in 2021. Climate risk disclosures are finally being mandated by governments — and insurance, pensions and banks committed to net zero through the Glasgow Financial Alliance for Net Zero at COP26. But, the urgency remains. This year we didn’t forecast climate change — we lived it. We learned a whole new vocabulary here in British Columbia casually speaking new phrases like ‘heat dome’, ‘waterspout tornado’ and ‘atmospheric river’.

Looking into 2022, we’re determined to keep up our pace to meet the challenge. Here’s a simplified rundown of this banger of a year:

January

Fund II launched with $30M already committed

Fund I invests in Aquacycl and Manifest Climate

February

Fund II first close at $41M with several returning investors and many exciting new partners like Fulmer Capital and First West Credit Union

Fund I invests in Carbon America and Audette

March

Sale of Inkblot to Greenshield Canada

Kim retained for brand update

April

Fund II makes its first investment in Encycle

ChopValue follow-on investment

Elyse joins as VP Operations

May

University of Victoria, Toronto Atmospheric Fund, Hamilton Community Foundation and clients of Genus Capital Management commit to Fund II

Clir follow-on investment

June

Fund II second close with Fondaction and Vancity for an oversubscribed $54M

July

Aquacycl Series A

August

Carbon America follow-on investment

September

EDC brings Fund II to $60M hard cap

Fund II invests in RailVision

October

Fund II invests in EnPowered

Qhalisa joins as Senior Analyst

November

Audette follow-on investment

December

Fund II invests in Clean Crop

Cayley joins as Talent Network and HR Manager

Solstice follow-on investment

Rain or shine, the race to Net Zero is on!

The climate crisis is the global challenge of our time, but it is especially alarming when the impact hits so close to home. We’re talking about the devastating BC floods that are wreaking havoc on homes, livelihoods and supply chains. The June heat dome, summer forest fires and now atmospheric rivers — the past six months have shown how serious the damage from extreme weather conditions is to our region and the planet.

The climate crisis is the global challenge of our time, but it is especially alarming when the impact hits so close to home. We’re talking about the devastating BC floods that are wreaking havoc on homes, livelihoods and supply chains. The June heat dome, summer forest fires and now atmospheric rivers — the past six months have shown how serious the damage from extreme weather conditions is to our region and the planet. While one of the most important food growing regions in BC was flooding, COP26 was fizzling down and making it clear that policy commitments alone won’t get us to Net Zero in time. To us the most encouraging development out of COP26 is the financial momentum announced at the conference — the Glasgow Financial Alliance for Net Zero (GFANZ) representing 245 financial institutions and $130 trillion committed to Net Zero, plus the International Sustainability Standards Board (ISSB) providing a comprehensive global baseline of reporting standards, governance and oversight for finance. In a nutshell, we need those trillions of dollars and global standards to:

While policy and politics need to pick up pace, faster moving flows of private capital are accelerating new innovative solutions that react to the risk and seize the opportunity. We are so fortunate to meet and get to know mission-driven founders that are solving the goals above. Even beyond the small subset of companies we invest in, there are 1000’s of brilliant entrepreneurs developing and growing companies that have significant climate benefits. Circular materials and supply chains, distributed sources of clean energy, revolutionary food science, ecosystem technology, sucking carbon straight out of the air and even perpetual energy through nuclear fusion are all innovations that are at the point of inevitability. Let’s hope that now climate change is our shared reality (not some hypothetical scenario) the confluence of policy, movements, innovation and investment will deliver a Net Zero reality. Spoiler: we think it will.

The Great Attraction

We’ve mentioned it plenty of times before but it bears repeating: for our companies to compete and succeed, they must attract and retain exceptional talent. Filling sales, tech and operations roles with high-quality candidates is fundamental to the growth of our portfolio companies, and their ability to reduce emissions at scale. Yet the talent market is increasingly competitive.

We’ve mentioned it plenty of times before but it bears repeating: for our companies to compete and succeed, they must attract and retain exceptional talent. Filling sales, tech and operations roles with high-quality candidates is fundamental to the growth of our portfolio companies, and their ability to reduce emissions at scale. Yet the talent market is increasingly competitive. Compounding the industry-wide need is the ‘great resignation’ wherein record numbers of workers are leaving their jobs. Globally, talented people are in search of flexibility, autonomy, belonging and purpose. But, in times of transition there is oppourtunity!

Earlier this month, we hosted our founders for another installment of our in-house learning collective ‘Active Academy’ focused on attracting key talent. Our guest speaker was Craig Miller, CMO and CPO of Shopify during its rocketship growth. Strategizing when/how to make a key hire, when to promote from within and when to recruit were all hot topics … but potentially the biggest takeaway was around how to create a high performing culture. Winning the 'great attraction' will require an alignment of mission, culture, incentives and performance so that world-changing ideas can attract the world-class talent they need.

Ocean obsessed

It’s important for us to keep our minds on the natural systems that regulate the climate while we are searching for technological solutions to mitigate climate change. Last month, our own Sophie Endl led a ‘Lunch & Learn’ session on the key role the ocean plays in the context of climate change and how we can invest for meaningful impact.

It’s important for us to keep our minds on the natural systems that regulate the climate while we are searching for technological solutions to mitigate climate change. Last month, our own Sophie Endl led a ‘Lunch & Learn’ session on the key role the ocean plays in the context of climate change and how we can invest for meaningful impact. The ocean regulates global weather systems and stores carbon through circulation — one third of all the carbon emitted by humans over the past 200 years is stored in the ocean and 83% of the global carbon cycle is circulated through the ocean. Even the creatures, like whales, contribute to the climate we all depend on. Whales accumulate carbon throughout their lives by eating phytoplankton, which is eventually stored at the bottom of the ocean when they die. A large whale sequesters about 33 tons of CO2 over its lifetime while a tree only absorbs up to 48 pounds per year!

We hear a lot about the negative impacts human activity and climate change are having on the ocean: rising sea levels, acidification, pollution, overfishing and eutrophication (when fertilizer causes abnormal algae blooms that deplete oxygen levels) — but we also need to keep in mind the positive contributions of natural systems so we can encourage investment and innovation. And even more reason to enjoy and appreciate your next scenic gaze at the ocean ... like we did while kayaking (see pic above).

Climate realists, optimists and Canada’s next rule makers!

What kind of climate investor would we be if we didn’t talk about the latest IPCC Report that dropped on August 9? The Intergovernmental Panel on Climate Change released the first of three installments of the Sixth Assessment Report earlier this month. The big takeaway is the certainty in the link between human-emitted carbon dioxide in the atmosphere, rising global temperatures, and accelerating climate impacts.

What kind of climate investor would we be if we didn’t talk about the latest IPCC Report that dropped on August 9? The Intergovernmental Panel on Climate Change released the first of three installments of the Sixth Assessment Report earlier this month. The big takeaway is the certainty in the link between human-emitted carbon dioxide in the atmosphere, rising global temperatures, and accelerating climate impacts. The report’s analysis of thousands of climate models gives detailed projections about possible future scenarios which — and this is crucial — depend on the choices we make about carbon today.

Bill Gates’s How to Avoid a Climate Disaster (a regular fixture on desks in our office) breaks the 51B tonne per year carbon problem into digestible segments:

If you’re looking for an antidote to climate doomsday-ism, we recommend Tony Seba’s RethinkX: Rethinking Climate Change, which details the groundwork that’s been laid in the energy, transportation, and food sectors for exponential growth in sustainability that will eliminate 90% of net greenhouse gas emissions by 2035. Moreover, (and this view is shared by Gates) the technologies needed are either commercially viable now or can be by 2025 with the right societal choices. Of the nine implications of the disruptions, “#4: Decarbonizing the global economy will not be costly, it will instead save trillions of dollars” needs special emphasis going into the Canadian federal election.

We’re not going to tell you who to vote for … let’s just all agree that action and collaboration is urgently needed … and what better time to demand it than today, from leaders vying for your vote?

Overshoots and scores!

If you’re like us, it can be depressing reading headline after headline about how dire the climate crisis is. Fires, floods, feedback loops … ffffff. Well, there are also some big things going in the right direction and we want to share some optimism.

If you’re like us, it can be depressing reading headline after headline about how dire the climate crisis is. Fires, floods, feedback loops … ffffff. Well, there are also some big things going in the right direction and we want to share some optimism. Last month the US and Europe put forward bold policy plans with legal teeth and strong economic incentives that, if ratified, can make a real difference. At nearly the same time, two new mega-funds were announced that are the largest ever climate-focused investment vehicles. Carrot and stick — funding and regulation — unrelated but intrinsically complementary.

Not to dismiss the seriousness of the situation. These funds and policy changes aren't a magic wand. July 29 was Earth Overshoot Day, marking the date ‘when humanity’s demand for ecological resources and services in a given year exceeds what Earth can regenerate in that year.’ But progress is good and hope is necessary, so let’s lean into the good for a moment.

Policy and incentive structures help companies gain market traction and later stage capital provides the resources to execute at a large scale (Active Impact sits between these two forces). In the US, the bipartisan infrastructure bill contains the largest ever energy, climate and mass transit provisions at roughly $127B. In Europe, the carbon border adjustment system will price the carbon emissions on selected imported products to prevent ‘carbon leakage’ and encourage the proliferation of carbon reduction incentives outside the EU. The regulatory tailwinds will spark innovation in climate tech, which will then be supported and stimulated by the massive available growth capital now coming online. TPG’s Rise Climate Fund just held a first close of $5.4 BILLION ($7B target) and Brookfield Asset Management held an initial closing of $7 BILLION ($12.5B target) for their Global Transition net-zero carbon economy fund.

While we know there’s so much more that can (and must) be done, these commitments build more momentum, and that’s welcome news.